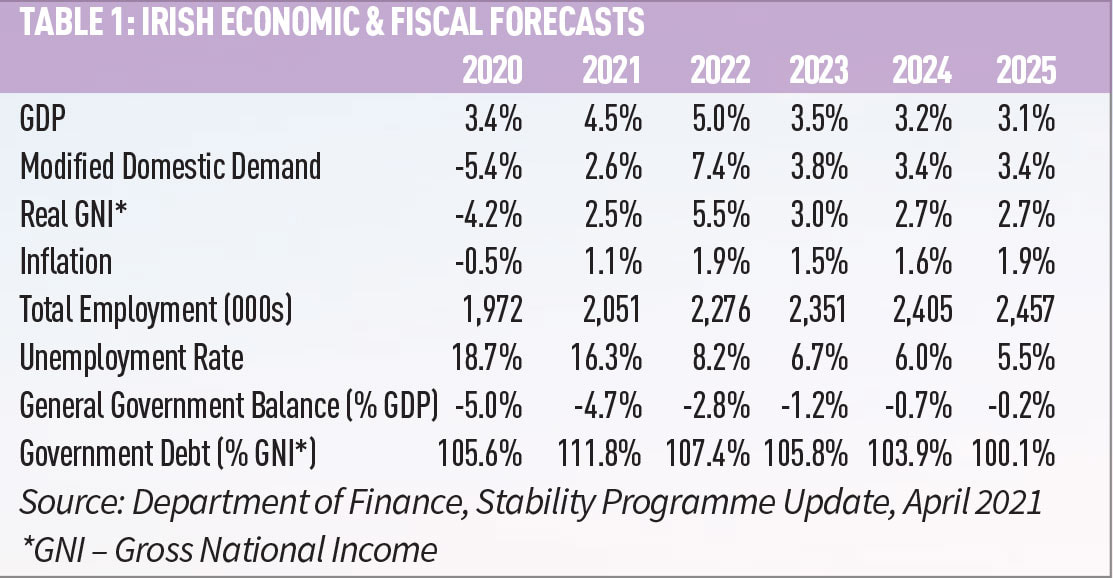

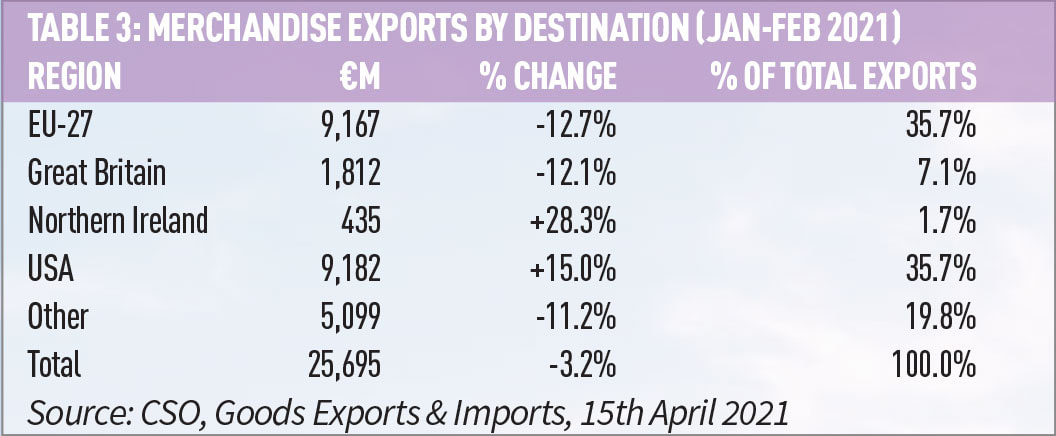

It is clear that the global economic recovery will not be smooth, and just as some countries and some sectors suffered more than others over the past year, the recovery in countries and amongst different sectors is set to be very uneven. Countries such as the US, UK and Israel are doing relatively well on the vaccine front, and their economies are returning to some semblance of normality. The EU has been doing less well, and varying levels of stringent restrictions have been kept in place. This will delay economic recovery. THE DUAL NATURE OF THE IRISH ECONOMY In Ireland, it has been a story of two very different economies and workforces. If one works in or operates in sectors such as foreign direct investment (FDI) companies; the public sector, where no jobs have been lost and a pay increase of 2 per cent was delivered last October; financial services; and professional services, the economic and financial environment has been good. However, if one works in or operates in tourism, hospitality, non-essential retail, personal services, the airline industry, or arts & entertainment, the environment remains very challenging. In April, the Department of Finance published its latest forecasts for the Irish economy. The Department of Finance is more optimistic about the second half of this year as restrictions are expected to be eased and as we return to a semblance of normality. GDP is projected to expand by 4.5 per cent in 2021, and the modified measure of economic activity (GNI*) is expected to expand by 2.5 per cent. This more modest outlook for modified growth reflects the fact that the country has been subject to significant restrictions since the beginning of the year, whereas the multi-national side of the economy has continued to do well. Looking to the medium-term, the expectation is that growth will steadily recover, and the labour market in particular will steadily improve. The budget deficit (General Government Balance) is projected to gradually improve, as is the level of government debt when expressed as a per cent of the more meaningful measure of economic activity, GNI*. All in all, the Department of Finance is relatively optimistic about recovery prospects, but the outlook is heavily contingent on positive epidemiological developments, and the risks are obvious. GROSS NATIONAL INCOME Merchandise exports were a key driver of Irish growth in 2020. However, 20201 has been somewhat more challenging to date. In the first 2 months of the year, the total value of exports was 3.2 per cent lower than the same period in 2020. With the exception of chemical and pharmaceutical exports, which increased by 6.4 per cent and accounted for a very high 67.6 per cent of total exports, all other categories were weaker. There is clearly a Brexit effect at play here. Exports to Great Britain declined by 12.1 per cent in the first 2 months of the year. Great Britain accounted for just 7.1 per cent of total exports, which is the lowest market share on record. Clearly, trade with the Great Britain has become much more difficult since 1st January, with increased delays, bureaucracy, and customs requirements. It remains to be seen if these are teething problems or a more fundamental structural alteration in the trading relationship with Great Britain. Looking ahead to the second half of the year, there are grounds for optimism regarding Ireland’s economic prospects. The export performance is likely to pick up as Brexit issues are gradually resolved (hopefully), and as the global economy strengthens. In addition, there is likely to be a lot of pent-up demand coming back into the economy. Consumer and corporate deposits have reached record levels due to COVID-19, due to consumers lacking the ability and confidence to spend, and business putting investment on hold given the very uncertain environment. As the restrictions are gradually eased, it is likely that business investment and consumer spending will rebound strongly. The recovery in Irish economic activity is likely to be uneven. It is unlikely that there will be any meaningful recovery in international tourism until much later this year and into next year, and trading conditions for the hospitality sector are likely to continue to be subjected to restrictions and increased health-related safety costs. Many of the jobs lost will not be recovered for the foreseeable future, and many of the businesses forced to shut down or seriously restrict activity, will either not re-open or struggle to survive once they do, unless they get significant and justifiable support from Government. After a very challenging 14 months, the prospects are definitely brighter, but epidemiology rather than economic fundamentals will primarily determine the timing and magnitude of the recovery in the sectors subjected to severe restrictions since March of last year. [email protected]

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

June 2023

Categories

All

|

-

Business to Business

Providing Step by Step Guidance

Get in touch for your free consulation today

Contact Us -

-

Over 30 Years Experience

Insight into all aspects and types of business

Get in touch for your free consulation today

Contact Us

We create custom business to business strategies. |

SITE MAP |

CONTACT DETAILS

|

|

©

2024 Ryan & Crowley Chartered Accountants

RSS Feed

RSS Feed