0 Comments

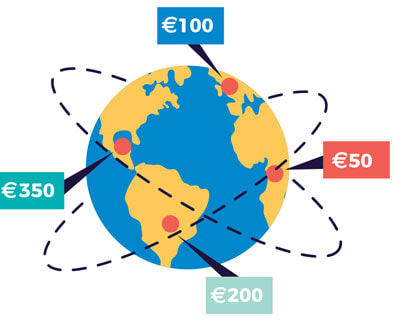

Since 1 January 2021, the UK is no longer a part of the EU’s Single Market and Customs Union, which has implications around VAT for businesses operating in the Republic of Ireland that import from the UK. The Irish government has introduced a facility called postponed VAT accounting for VAT registered businesses to avoid the payment of import VAT at the point of entry.

This new measure allows you to record the VAT on your VAT return rather than paying it at the point of entry into the State but will not apply to goods brought in from Northern Ireland. For the past number of weeks, headlines have highlighted the negative impact of the new Trade and Co-Operation Agreement (TCA) that has come from Brexit. However, in the words of Albert Einstein “In the midst of every crisis, lies great opportunity”. Read on to discover five such opportunities that you could capitalise on.

|

Archives

June 2023

Categories

All

|

-

Business to Business

Providing Step by Step Guidance

Get in touch for your free consulation today

Contact Us -

-

Over 30 Years Experience

Insight into all aspects and types of business

Get in touch for your free consulation today

Contact Us

We create custom business to business strategies. |

SITE MAP |

CONTACT DETAILS

|

|

©

2024 Ryan & Crowley Chartered Accountants

RSS Feed

RSS Feed