|

In this article we aim to touch on a number of key pension areas for clients as they navigate their way through the current pandemic and evolving government and EU policy on pensions. We look at the rise in popularity of Self invested pensions in the current market, the importance of pensions funding as part of retirement planning but also a part of client’s business exit strategy and direct property as an asset class in your pension. Self Invested Pension Market Since the last major market correc_on in 2007 pension investors have been looking for tangible assets to invest in. The Self invested market allows them access to this. The figures reinforce this as over the last 15 years the market has grown from 3% of the total defined contribu_on market to 16% of the market, primarily driven by the desire of clients for greater investment choice, which includes;

As you can see the choice is very broad and there are specific Revenue rules which apply to all investments however clients are demanding this type of choice. With this level of choice, the need for sound financial advice and guidance is vital and cannot be understated. As the pension administrator, Newcourt require all clients to engage a financial advisor to help them maximise the benefits of pension funding and investment. Pension Funding The need to consider all of the options available on disposal of a business is imperative and in many cases it is a combination of the following:

Pension funding is a vital element when planning a client’s business exit strategy. The current tax efficient threshold for pension planning is €2,000,000 per individual. When considering how a client should fund, one needs to consider a number of factors as follows:

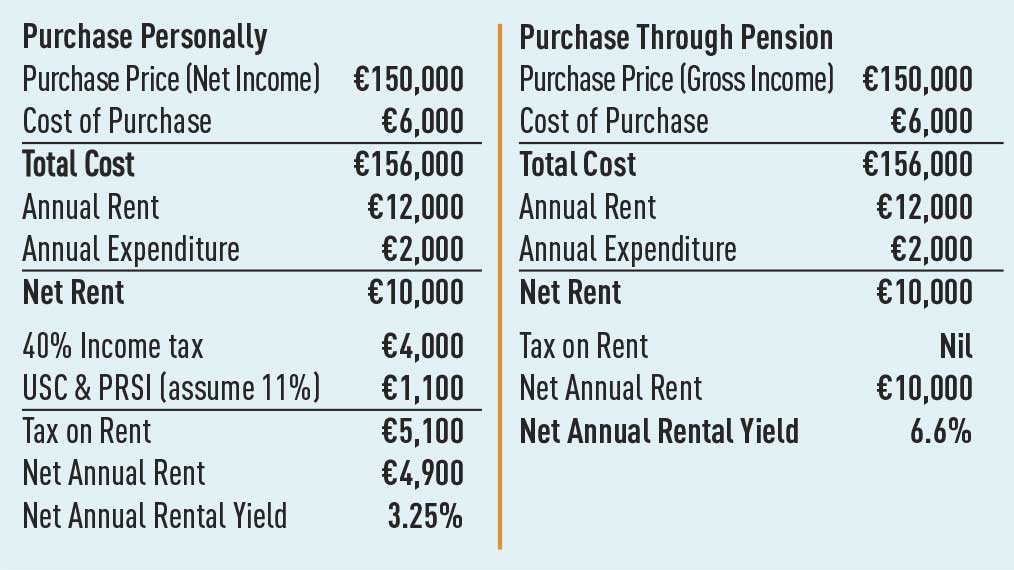

Property as an asset class Over the years direct property investment has proven popular and in the longer term a great investment for many. In the example below we have set out a very simple example of the tax reliefs available and how, if your client wishes to invest in property, pension investment is the most tax efficient way to do so. As you can see purchasing a property with tax exempt funds, a company has received full corporation tax relief on the contributions, the rents and any capital gain are tax exempt within the fund on disposal. However, many pension investors hold on to the property to provide pension income in retirement and simply transfer the property, in its actual form, to their Approved Retirement Fund.

Pension Tax Exemption:

All investment income and gains are tax exempt within the pension structure. This makes your pension fund the ideal place to purchase property. We believe property will continue to be a core investment asset of Self invested pensions. Please note Revenue rules apply to all pension property investments and the purchase of property is for long term investment purposes only and not for development purposes. If you require any further details please contact: [email protected]

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

June 2023

Categories

All

|

-

Business to Business

Providing Step by Step Guidance

Get in touch for your free consulation today

Contact Us -

-

Over 30 Years Experience

Insight into all aspects and types of business

Get in touch for your free consulation today

Contact Us

We create custom business to business strategies. |

SITE MAP |

CONTACT DETAILS

|

|

©

2024 Ryan & Crowley Chartered Accountants

RSS Feed

RSS Feed