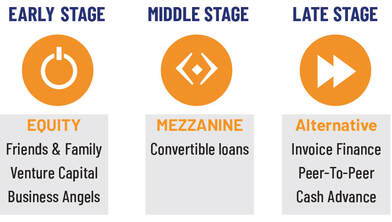

Typically, high potential startups go on to raise growth equity via venture capitalists (the most expensive form of equity) or equity crowdfunding sites such as Seedrs and Irish company Spark Crowdfunding. The established but still relatively small to medium sized businesses look to the AIM (the alternative investment market), whereas the next league of businesses move to public exchanges like the ISEQ or London Stock Exchange. MEZZANINE FINANCE Mezzanine finance is best suited to large businesses because it is a hybrid of equity and debt, it is less costly than equity alone but still comes at a premium to the business. The major drawback of mezzanine finance is that it often comes with covenants that can outline specific Key Performance Indicators (KPI’s) or targets that must be met. If they are not achieved the mezzanine provider can convert their loan into equity which is important to consider given the impact it will have on the capitalisation table and the dilution this could have on existing shareholders. WHAT ARE THE NEWER FORMS OF FINANCE? Smart businesses will have, what is often referred to, as a ‘smart capital mix’. A blend of finance products that give a business resource capacity when growing, flexibility when required and cost effectiveness to maintain or improve the bottom line. This is where newer and alternative sources of finance have found their place in the market. Invoice financing, peer-to-peer lending and cash advance solutions solve different needs of a business and are often used interchangeably. Different products are designed for different stages of a business’s life-cycle. -INVOICE FINANCE

Invoice Finance works by selling outstanding invoices at a discount to the financial provider. The provider can, in some instances, provide debtor collection services and the facilities can be disclosed (made evident to your debtors) or done discreetly. This type of financing is a great option if you want to accelerate the realisation of your revenue by accessing the finance tied up in your invoices quickly. The less established or poorer credit ratings of your debtors the larger the discount that will be applied to the invoices. While this can make invoice financing an expensive type of funding, the cost of the facility is usually covered within the discount and there is no future repayment required. However, if you already have granted a debenture to another party, this will generally include your invoices. This makes invoice discounting very difficult. Invoice financing is provided by traditional banks, but it is also provided by alternative finance providers in Ireland such as Grenke and Bibby Financial Services. We will continue this article in our next issue by exploring Peer-to-Peer Loans and Cash Advance. If you have any questions on the above, please contact us today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

June 2023

Categories

All

|

-

Business to Business

Providing Step by Step Guidance

Get in touch for your free consulation today

Contact Us -

-

Over 30 Years Experience

Insight into all aspects and types of business

Get in touch for your free consulation today

Contact Us

We create custom business to business strategies. |

SITE MAP |

CONTACT DETAILS

|

|

©

2024 Ryan & Crowley Chartered Accountants

RSS Feed

RSS Feed