|

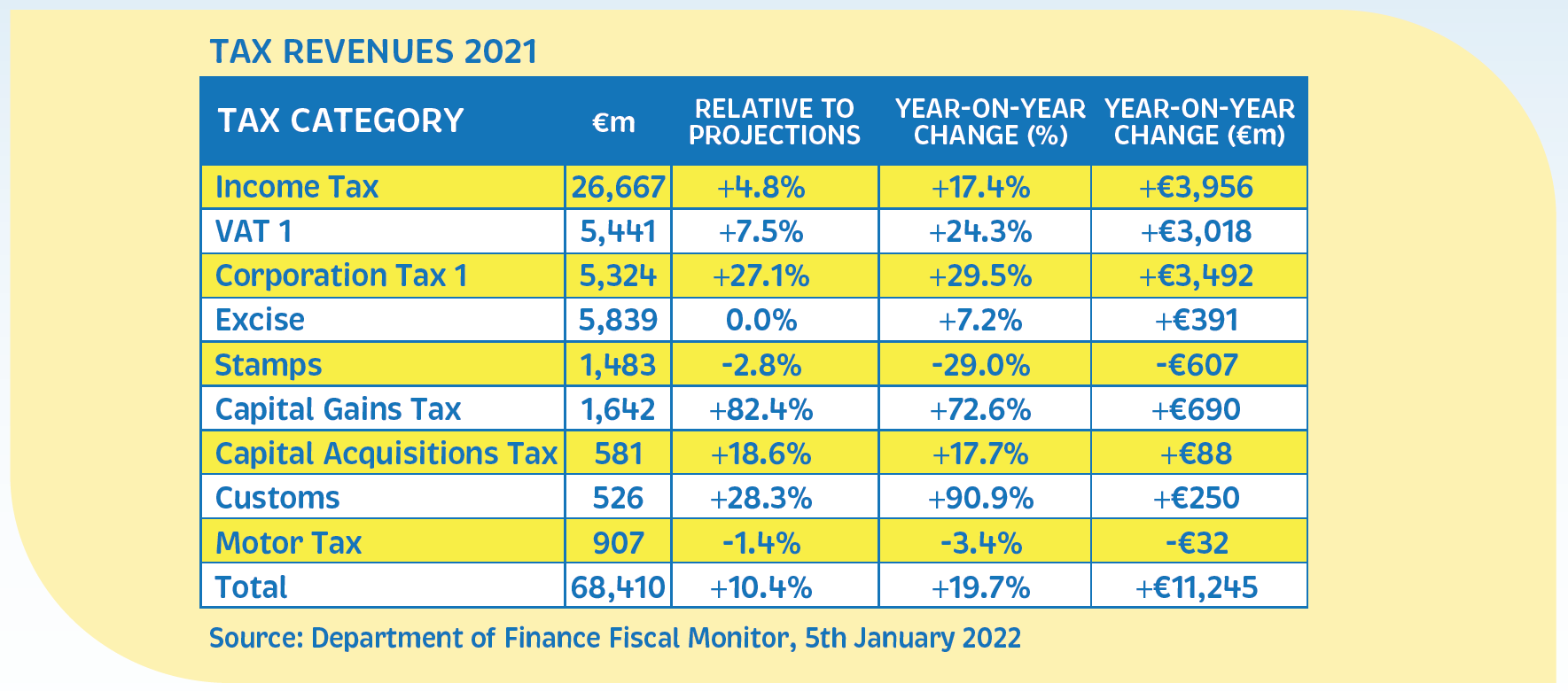

The past couple of years have been shrouded in uncertainty and volatility, largely due to epidemiological and political events, rather than economic fundamentals per se. However, it is not possible to divorce economic developments from politics and pandemics, as they have had and continue to have a significant impact on economic performance. Before looking at the year ahead, it is always worthwhile to look back at what I said in this piece a year ago to see how that turned out. Last year I had to eat humble pie as the declaration of a global pandemic a few weeks after I wrote an upbeat piece in February 2020 changed everything. This time last year I said that looking ahead to 2021, “it is possible to be optimistic about the global and the domestic economy. This is of course subject to all of the caveats about the mutating virus and the vaccines. The very stringent restrictions put in place here in Ireland and in many other countries at the end of 2020 could last well for the first quarter and possibly into the second quarter, and will obviously have a very significant impact on economic activity. There is not a lot that can be done about that. It is necessary to bring infection levels down, but the Irish Government will have to con琀nue to provide strong financial support to households and businesses for the foreseeable future. The hope is that an effective vaccine programme will be rolled out as quickly and efficiently as possible, and restore some semblance of normality to the economy and society in the second half of the year.” This is pretty much how things panned out, and despite significant restrictions for a substantial part of the year, the Irish economy performed strongly. In the final quarter of 2021, the level of employment in the economy reached a record high of 2.5 million; the unemployment rate declined to 5.2 per cent of the labour force in January 2022, down from 7 per cent a year earlier; house prices continued to be driven higher by strong demand and limited supply, and in the year to the end of December, national average house prices increased by 14.4 per cent and rents increased by 8.4 per cent; the value of retail sales was 11.7 per cent higher than in 2020; and new car registrations totalled 104,932, which represents an increase of 18.8 per cent on 2020. The performance of the Exchequer finances was stellar during 2021. For the year as a whole, the Exchequer borrowing requirement (EBR) came in at €7.37 billion, which is down from €12.31 billion in 2020. This is a strong financial position given the exceptional circumstances that have prevailed over the past couple of years. The key feature of the public finnances in 2021 was the buoyancy of tax revenues.

It is important to recognise the dual nature of the economy, which the aggregate statistics don’t really reflect. Sectors such as FDI, professional services, financial services, the public sector and essential retail had a good year in 2021 and should continue to do well in 2022. However, for non-essential retail, the broad hospitality sector, the airline industry, arts and entertainment, and various personal services, 2021 was a second consecutive challenging year due to Covid-related restrictions. However, with restrictions now virtually removed, a strong rebound in those sectors looks likely.

The escalating cost of living has become an issue of considerable political and social concern in recent months. In the year to December 2021, average Irish consumer prices increased by 5.5 per cent, which is the highest annual rate of inflation since April 2001.It eased to 5 per cent in January largely due to post-Christmas sales. Globally, Covid-19 has had a significant disrupting influence on supply chains and shipping; energy prices are escalating, particularly oil and natural gas; and repressed demand due to Covid restrictions is rebounding very strongly. The oil price is the mechanism by which the Ukrainian war could derail the global economy. It spiked rapidly after the invasion but there has been some easing in it since. Current economic forecasts are based on $120 per barrel on average in Q2 and then subsiding to a range of $90 – $100 in the second half of the year. So far so good, but we need to watch it. Higher energy prices, if sustained, will result in a big hike in inflation and damage the economic outlook by cutting spending power. Covid will obviously remain on the agenda, but there are many other events of significant interest. These include the bedding in to power of Olaf Scholz in Germany and the end of the Merkel era; the French presidential election in April; the mid-term elections in the US in November, which could see a strong re- emergence of the Trump wing of the Republican party and the basis for another run at the presidency in 2024; the growing antagonism between China and the US and others; the Russia / Ukraine crisis; climate change will continue to drive global policy, as it should to an even greater extent; the growing construction- related debt crisis in China caused by the near collapse of China’s largest property developers who have more than $300 billion in liabilities, leaving 1.5 million buyers waiting for finished homes. Brexit and the Northern Ireland protocol; and the reaction of central banks to inflation and the possibility of higher interest rates in many jurisdictions. Inflation will dominate on the economic front for the immediate future. The US Federal Reserve and the Bank of England look set to increase interest rates more aggressively. The ECB is still relaxed, despite a headline inflation rate of 5.1 per cent. However, I believe there is a heightened risk of modest tightening by the ECB later in 2022 and Irish borrowers should start to factor in this possibility. One can never predict the future with any degree of certainty, but it is important to take cognisance of the risks out there and take appropriate action. For Irish employers, the recruitment, retention and cost of staff will be a big challenge in 2022, with a very tight labour market and serious staff shortages across the economy. Employers will have to pay higher wages and also facilitate in so far as possible the working requirements and preferences of staff in the post- Covid world. Working from home and a hybrid working model are likely to become a significant feature of the Irish labour market. If employers do not show appropriate flexibility, employees will be in a relatively strong position to vote with their feet. Such is the nature of a tight labour market and consequent skills shortages. For consumer facing businesses, demand is likely to be strong in 2022. Domestically, the labour market looks set to continue to improve; incomes will grow on the back of wage pressures, although elevated inflation and high housing costs will pressurise real incomes; and household savings reached a record high of €136 billion in October, although they declined slightly to €134.8 billion in November. This provides the basis for strong growth in consumer spending this year. FDI should continue to expand in 2022, and it seems likely that the impending global corporation tax changes will not have too much impact on Ireland’s FDI model. All in all, there are reasons to be optimistic about the coming year, but every economic forecast should be caveated by uncertainty and the notion that one should always expect the unexpected. From a political, economic and social perspective, housing will be the key issue over the coming year. [email protected]

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

June 2023

Categories

All

|

-

Business to Business

Providing Step by Step Guidance

Get in touch for your free consulation today

Contact Us -

-

Over 30 Years Experience

Insight into all aspects and types of business

Get in touch for your free consulation today

Contact Us

We create custom business to business strategies. |

SITE MAP |

CONTACT DETAILS

|

|

©

2024 Ryan & Crowley Chartered Accountants

RSS Feed

RSS Feed