|

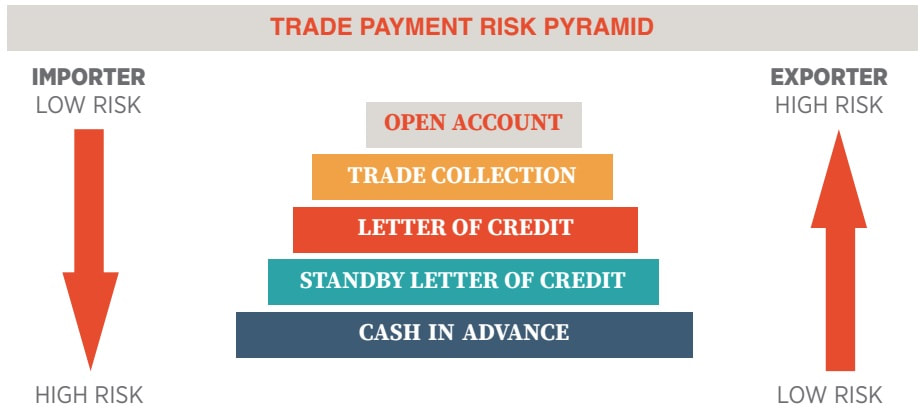

To succeed in today’s global marketplace and win sales against foreign competitors, Exporters must offer their customers attractive sales terms supported by the appropriate payment methods. Because getting paid in full and on time is the ultimate goal for each export sale, an appropriate payment method must be chosen carefully to minimize the payment risk while also accommodating the needs of the Importer. International trade presents a spectrum of risk, which causes uncertainty over the timing of payments between the Exporter (seller) and Importer (buyer). Therefore, Exporters want to receive payment as soon as possible, preferably as soon as an order is placed or before the goods are sent to the Importer. And of course Importers want to receive the goods as soon as possible but to delay payment as long as possible, preferably until after the goods are resold to generate enough income to pay the Exporter’s invoice. As shown below, there are five primary methods of payment for international transactions. During or before contract negotiations, Exporter should consider which method is desirable and appropriate depending on the relationship with the Importer. OPEN ACCOUNT

An open account transaction is a sale where the goods are shipped, delivered and payment remitted by the Importer on an agreed date without any role played by their banks. The Exporter ships the goods and issues an invoice to the Importer without any guarantee that the invoice will be paid. The Importer takes receipt of the goods and notes the date payment is expected by the Exporter. This can be any period from day of receipt of goods to 90 days later depending on what was agreed at contract negotiations. The Exporter then waits for payment to arrive in their account on the agreed date. Obviously, this is one of the most advantageous options to the Importer in terms of cash flow and cost and control over the payment decision but it is consequently one of the highest risk options for an Exporter. Because of intense competition in export markets, Importers often press Exporters for open account terms since the extension of credit by the Exporter to the Importer is more common abroad. Therefore, Exporters who are reluctant to extend credit may lose a sale to their competitors. Exporters can however offer competitive open account terms while substantially mitigating the risk of non-payment by insuring the risk of non-payment using export credit insurance. TRADE COLLECTIONS Trade Collections do not provide any guarantee of payment, and are therefore more widely used where the Importer and Exporter have established a good trading relationship. The Importer agrees to pay for goods only upon receipt of documents evidencing the shipment of the goods by the Exporter. There are two types of trade collections and their usage will depend on the payment terms agreed. In both cases the Exporter entrusts the collection of the payment for a sale to its bank (remitting bank), which sends the documents relating to the shipment to the Importer’s bank (collecting bank). Cash against Documents (CAD) In this case the documents are entrusted to the Importer’s bank with instructions to only release the documents to the Importer against payment. This is a common method of payment for goods shipped by sea where bills of lading are issued. Even though the Exporter has shipped goods without any guarantee of payment, the Exporter has the comfort of knowing that the Importer cannot access the goods without the bills of lading and cannot get the bills of lading without paying in full. So should there be an issue with payment, the Exporter can recall goods or sell to another party. Bills of Exchange Bills of exchange are used where there are deferred credit terms agreed. A bill of exchange is a written order issued by the Exporter and drawn on the Importer binding the Importer to pay a fixed sum at a future determinable date. By signing a bill of exchange, the Importer is formally acknowledging that the funds are due and payable on the agreed date (note that this is not a guarantee and is only an acknowledgement of the amount owing though can be used in any legal proceedings against the Importer for non-payment). Unlike CAD above, here the documents are sent to the Importer’s bank with instructions to deliver the shipping documents to the Importer against their signing a bill of exchange acknowledging the amount due and the date for payment. This method creates additional risk for the Exporter as the Importer will receive goods before payment becomes due and may use quality issues to seek a discount or may default on their payment obligation entirely. Although banks do act as facilitators for their clients, Documentary Collections offer no verification process and limited recourse in the event of non-payment and are therefore generally less expensive than Letters of Credit. They do give the privilege to a buyer to reject the consignment if it does not meet the quality standards. While this is not a method of payment, it does offer some form of protection for the buyer. Kieran O’Byrne, Head of Trade Finance AIB The above information is to be an overview of some methods of payment that are available to you. In our next issue in early 2022, we will discuss more methods of payment such as Letters of Credit, Standby Letters of Credit and Cash in Advance. In the meantime, if you have any further questions, contact your financial advisors.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

June 2023

Categories

All

|

-

Business to Business

Providing Step by Step Guidance

Get in touch for your free consulation today

Contact Us -

-

Over 30 Years Experience

Insight into all aspects and types of business

Get in touch for your free consulation today

Contact Us

We create custom business to business strategies. |

SITE MAP |

CONTACT DETAILS

|

|

©

2024 Ryan & Crowley Chartered Accountants

RSS Feed

RSS Feed